How to become a contractor – and significantly boost your salary

Becoming your own boss is a dream many people will have at some point in their careers. The freedom to manage your own time and benefit from tax breaks are just some of the sought-after benefits of being self-employed.

However, while it has its upsides, there are significant legal and financial implications of working for yourself.

And once you have made the big decision to give up working for someone else, there are plenty of other choices to be made, such as how you structure your company and work with clients. One option is working as a contractor, usually remaining within the same field as you had been employed in.

Telegraph Money explains how to prepare to be your own boss.

What is a contractor?

A contractor is someone who doesn’t have a fixed employer but instead, as the name suggests, works for one company for a fixed – or contracted – amount of time. They’ll provide specific services for a client, for example, a specialist who has been brought in to manage a particular project.

Although they are often grouped together, contractors and freelancers operate slightly differently. A freelancer is likely to be working on multiple pieces of work at any given time, often for several clients, and is paid on the basis of each commission. Contractors will usually work with one client for the duration of each fixed-term contract.

Whether being a freelancer or a contractor is a better option for you will likely depend on your circumstances – for example, freelancers generally have more flexibility, but work and pay may be more sporadic.

It may also depend on your area of work. Some sectors are more likely to have a need for freelancers rather than contract-based workers.

Can you earn more as a contractor?

Your potential for earning more as a contractor will likely depend on variables such as your experience, location, skill set and the demand for specific services.

However, Habiba Khatoon, director at global recruitment consultancy Robert Walters, says it is generally true that contracting can offer higher hourly rates or project fees compared to traditional employment.

“This can be pushed up if there is a specific or specialised skill set that the company is after, industry demand is particularly high, and you have a proven and stellar track record of delivery,” he said.

According to figures from Robert Walters, an HR adviser based in the north of England could earn £30,300 a year as an employee, but could get £230 a day as a contractor resulting in a comparable salary of £40,574.

Similarly, a supply chain manager working in the Midlands could earn £58,400 on a permanent contract, but £600 a day as a contractor, equalling an income of £108,527. However, it doesn’t work in all cases. An accounts assistant in London earning £27,000 as an employee would only make £135 or £23,126 a year as a contractor.

What’s more, while some contractors’ take-home pay can be increased compared to the salary of an employee, they will lose out on employee benefits such as a workplace pension and other perks such as salary sacrifice schemes and private healthcare.

Can you become a contractor?

If you think becoming a contractor might work for you, one thing to weigh up is when in your career you’ll choose to make the move. While there isn’t necessarily a good or bad time to do it, much of the decision will depend on your circumstances.

Firstly, consider your experience, how much demand there is likely to be over the coming years for your skill set, and if you think your network of contacts is strong enough to support the change.

“Building relationships and expanding your network can be crucial for finding contracting opportunities,” said Mr Khatoon.

Dave Chaplin, CEO of Contractor Calculator, suggested looking at online jobs boards to get a sense of the level of need for your skills, and the likely pay you could get.

You could also submit some speculative applications to see how you do, he said, as agencies are unlikely to ask for employer references.

There is also a value to specialising, he said, as developing a niche skill and knowledge base may position you well compared to others in your field who are more generalists. The catch is, you’ll need experience to develop this kind of specialist knowledge.

“If you are fresh out of university it is unlikely that you can get a high rate as you aren’t bringing experience. You need to be a specialist rather than a generalist to earn the high fees,” he explained.

“In copywriting, Chat GPT has taken a lot of that work. So if you are a copywriter you want to be a specialist – for example, in the pharmaceutical sector within business writing, and be able to read and assimilate research papers, as AI hasn’t got there yet.

The final thing to think about is whether you are prepared for the loss of the benefits that come with employment, and the fact that work may be more unreliable.

“While the amount you earn per day on an individual day may be higher, you need to consider the fact you won’t be working all the time,” said Mr Chaplin.

When making the decision, a good place to start is to look at your current financial situation and if you have funds to cover gaps in income that you may face early on.

How to prepare to become a contractor

To get yourself up and running, you first need to decide whether you want to set up your own limited company or operate under an umbrella company.

An umbrella company is a business you’ll sign up to, which employs you and pays your wages via Pay As You Earn (PAYE) – in the same way as employees are paid.

The benefit of this is that the company will manage all of the administrative side of being a contractor, and you’ll receive a net salary once a week or month. It is often used by recruitment agencies to pay workers, which is a common option for consultants.

As you’re employed by the umbrella company, you’ll also get the benefits of being an employee, such as paid holiday.

However, this setup doesn’t allow you to make use of the beneficial tax arrangements for contractors, and you will likely have to sign up to the umbrella company’s contract for services.

The cost to use a good umbrella company is around £25-£35 a week, according to Hiscox, an insurance firm.

If you decide to set up by yourself you will need to form a limited liability company. In this scenario, you will be the director of your own company, and can “pay” yourself for the work you carry out. To minimise tax, it’s common for directors to pay themselves a relatively small salary, and then receive more money as dividends from the company, where tax is charged at a lower rate than income tax.

However, this option comes with the added hassle of registering the company with HMRC and Companies House, submitting tax returns for yourself and corporation tax returns for the business, and making sure you have the right insurance policies in place to cover yourself and members of the public (if applicable). Telegraph Money’s guide to setting up your own company explains the steps you’ll need to take.

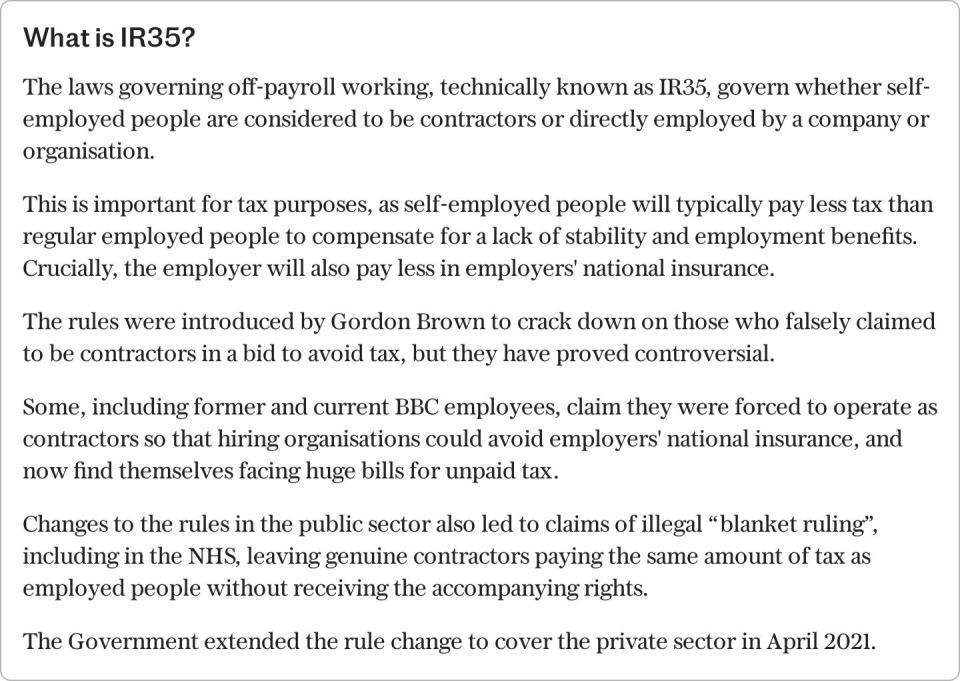

What is IR35?

One of the main hurdles when establishing yourself as a contractor is getting your head around IR35 tax law.

The legislation is designed to work out whether a contractor is genuinely self-employed or should be treated as an employee for tax purposes, known as being inside or outside IR35.

If you are inside IR35, this means HMRC does not consider you as being self-employed. It considers you an employee of your client, meaning you should pay the same tax and National Insurance as other employees, and the company should provide you with the same employee benefits.

If you are outside IR35, then HMRC considers you self-employed. This means no income tax and National Insurance contributions will be deducted at source when you are paid, and you must instead pay tax via self-assessment.

Being inside IR35 has a direct impact on a contractor’s take-home earnings. Contractors may receive up to 30pc less in their pay packet because they are taxed at source.

To get around this, there are tax avoidance schemes offering to help contractors get around the off-payroll working rules – but using these schemes can have dire consequences, such as the loan charge scandal, which has seen some contractors asked to repay huge sums in tax penalties.

Don’t forget your pension

Once you become a contractor you are responsible for your own pension contributions, as you will no longer benefit from workplace auto-enrollment. As a result, it can be easy to push this saving down your priorities list; just 16pc of self-employed workers pay into a pension compared to 88pc of workers eligible for auto-enrollment.

However, you can set up a pension yourself. A good place to start is by tracking down any existing workplace pension pots you have and consolidating them into one place, according to provider PensionBee.

You can then set up and pay into a private pension using options such as a Self-Invested Personal Pension (Sipp) or a Lifetime Isa. Private pensions still benefit from government tax relief, which will automatically boost what’s in your pension pot by the highest rate of income tax you pay.

Yahoo Finance

Yahoo Finance